Publications

美國信託與跨境傳承

附 錄

附錄三、四頭在外信託架構之法律備忘書

DAY PITNEY LLP

7 Times Square, Times Square Tower

New York, NY 10036

(212) 297-5829

Fax: (212) 916-2940

Boston Connecticut Florida New Jersey New York Washington, DC

TO: Peter Lu, KEDP

FROM: G. Warren Whitaker

Carl A. Merino

DATE: November 13, 2017

RE: Reporting Requirements for Delaware Trust with Non-U.S. Settlor

信託對非美國設立人的申報要求

You asked us to explain certain U.S. federal tax and information reporting requirements for a trust settled in Delaware (the “Trust”) by a non-U.S. settlor (the “Settlor”). A Delaware trust company would serve as Trustee and a non-U.S. person would serve as the Protector with the power to remove and replace the Trustee.1 We understand that the Trust would own 100% of the shares of a BVI corporation which in turn would own 100% of the stock of a Chinese corporation with operations in mainland China and a Taiwanese corporation with operations in Taiwan. The Trust would not own any tangible or intangible U.S. assets.

1 The Protector may have other powers as well.

您要求我們解釋Delaware信託對非美國設立人的聯邦稅務和信託申報的規定。信託前提:受託人為Delaware的受託公司,保護人為非美籍人士,並有權力移除或更換受託人。此信託持有一家BVI公司100%的股權,而該BVI公司分別100%持有一家中國公司及臺灣公司,並且此信託不會擁有任何美國的有形或無形資產。

KEDP 補充解釋:意見書的解釋前提是,此信託只有受託公司跟美國有關(司法管轄地),其他不論是設立人、保護人、投資顧問、分配委員(信託控制者)、受益人、信託持有的資產,完全都與美國無關。

You asked us whether the Trust would have to file income tax returns, FBARs or Forms 5472 in the U.S. and whether distributions from the Trust to non-U.S. beneficiaries would be subject to withholding taxes in the U.S. As discussed below, the Trust would qualify as a foreign trust for U.S. tax purposes based on the facts presented to us. As such, the Trust could have FBAR filing obligations with respect to foreign financial accounts held by the Trust, the BVI holding company or the Chinese or Taiwanese subsidiaries, but would not have to file a federal income tax return or Form 5472 in the U.S. and would not be obligated to withhold U.S. taxes from distributions to the non-U.S. beneficiaries. This would be the case regardless of whether the Trust was revocable or irrevocable. However, we note that if there will be any U.S. beneficiaries in the future, an irrevocable trust, if not properly structured, could present significant tax and reporting issues for the U.S. beneficiaries. As discussed at the end of this memorandum, there could be tax and reporting obligations in other jurisdictions.

您問我們這樣信託是否需要申報所得稅表、FBAR或5472表,以及信託對非美國受益人的分配是否會被預扣稅?如下所述,根據我們得知的信託資訊,本信託在美國稅目的下將被視為境外信託。如果信託、BVI控股公司,中國公司或臺灣公司持有境外金融帳戶,就會有申報FBAR的義務,但並不會有申報所得稅表、5472表或對非美國受益人的分配預扣稅的義務。無論信託為可撤銷或不可撤銷皆不會受到影響。但值得注意的是,如果未來不可撤銷信託中有美國受益人,該美國受益人在信託沒有適當的規劃下可能會面臨巨大的稅務及申報問題,如同本備忘錄最後會提到的,其他司法管轄區可能會有不同的稅務和申報義務規範。

KEDP 補充解釋:我們尋問在以上境外信託的前提,這個信託是否需要申報:1.所得稅表、2. FBAR、3. 5472表、4.非美籍受益人是否有所得稅的問題。律師回答:在以上架構,此信託就是個境外信託,不需要申報任何所得稅表、5472表,或是任何非美國來源信託所得的預扣問題,但是因為受託人是美國受託公司,受託公司須申報FBAR(律師強調了境 外不可撤銷信託和美國受益人會有巨大的稅務問題)。

A. Facts and Assumptions

We have assumed for purposes of our analysis that the individual transferring assets to the trust (the “Settlor”) will be a person who is not a U.S. citizen or resident for U.S. federal income tax purposes (a “nonresident alien”), never has been a U.S. citizen or long-term resident and is not expected to later become a U.S. citizen or resident.2 We also have assumed that the Settlor will be a person who is not domiciled in the United States for purposes of the U.S. federal estate, gift and generation-skipping transfer tax.3 We have made the same assumptions regarding the Protector and any other person who will control any “substantial decisions” of the Trust (defined below). We do not address possible legal consequences under the laws of the country where the Settlor may be resident or domiciled or where any of the underlying companies are organized. We also do not address state or local tax considerations in the U.S.

2 In general, individuals who are U.S. green-card holders and those who meet the “substantial presence” test will be resident in the United States for income tax purposes, although certain treaties can alter this result. Under the substantial presence test, an individual must generally be physically present in the United States for 31 days in the current calendar year and for a total of at least 183 days on a weighted basis during the current and two preceding calendar years, taking into account 1/3 of the number of days present in the United States during the preceding calendar year and 1/6 of the number of days present in the United States the year before that. Section 7701(b)(1)(A) of the Internal Revenue Code of 1986, as amended (the “Code”). Unless otherwise specified all Section references in this memo are to the Code and applicable Treasury Regulations.

一般來說,滿足「實質性存在」測試的美國綠卡持有者將在美國所得稅上視為美國居民,但某些協定可以改變這一結果,在實質性存在測試中,個人通常必須在本日曆年間在美國境內達到31天,並在目前和前兩個日曆年內,加權總共至少183天以上(前兩個日曆連算法為前一日曆年在美國的天數的三分之一以及前兩日歷年在美國的天數的六分之一,參照經修訂的1986年國內稅收法典(「稅法」)第7701(b)(1)(A)條規定,除非另有規範,否則本備忘錄中的所有部分均以「稅法」和適用的「財務條例」為準。

KEDP 補充解釋:只要當年在美國超過31天,前年的六分之一加上去年的三分之一,今年得總天數大於183天,就會滿足實質性測試。

3 A person is domiciled in the United States if he lives in the United States and has no definite present intent to leave, as shown by the surrounding facts and circumstances. See Treas. Reg. Section 20.0-1(b).

「固定居住於美國」一詞是指依周圍事實和情況所示,該個人沒有明確離開美國的意圖。請詳 Treas. Reg. Section 20.0-1(b)。

為了我們的分析目的,我們假定設立人為非美國公民,並在美國聯邦所得稅下認定為非居民外國人,且從未及將來也沒有成為美國公民或長期居住在美國的打算。為了美國聯邦遺產稅、贈與稅及隔代移轉稅目的,我們還假定設立人是不居住在美國的人,同樣的假定我們也套用在保護人及其他有重大信託控制權的人身上。此備忘錄內容不包含設立人居住地或信託下的任何公司所在地所可能產生之法律風險,並且也不包含美國州稅或地方稅的稅務風險。

KEDP補充解釋:我們此處假設的非美國設立人、非美國保護人,指的就是非公民、非綠卡、非達到居住測試183天,在未來也無意圖移民美國的人。此外,這裡也不考慮地方、州法,只對聯邦所得稅提出看法。

B. Foreign Trust for U.S. Tax Purposes

Because the rules governing residence status of a trust for U.S. tax purposes are drafted in favor of foreign status, it is not unusual for a trust settled in a U.S. jurisdiction such as Delaware and with a U.S. trustee to nonetheless be classified as a foreign trust for U.S. tax purposes. Such trusts are sometimes referred to as “hybrid” trusts. In order for a trust to be a U.S. trust for tax purposes, it must satisfy both a “court” test and a “control” test:

在美國稅下的信託居留身分規定是對外國人身分較友善的,因此,很常可見有美國籍受託人的信託在美國管轄地(例如Delaware)下,被判定為美國稅下所指的境外信託。該信託有時會被稱為「混合」信託。如果要成為美國信託,必須同時滿足「法庭測試」和「控制測試」:

KEDP補充解釋:要成為美國信託,要同時符合法庭測試、和控制測試。

(i) A court in the U.S. must be able to exercise primary (but not exclusive) jurisdiction over the administration of the trust, and

美國的法院必須能夠對信託的管理行使主要(但不是獨有)的管轄權,以及

(ii) U.S. persons must control all “substantial decisions” of the trust (such as power over distributions, the power to add beneficiaries and the power to remove and replace trustees).

美國人必須控制信託的所有的「重大決定」(例如分配權、增加受益人的權力以及移除和替換受託人的權力)。

As explained below, the Protector, who will be a non-U.S. person, likely would cause the Trust to be considered a foreign trust for U.S. tax purposes notwithstanding that it may have a U.S. Trustee and be governed by the laws of a U.S. state.

下面會解釋到,儘管信託有美國籍受託人及受美國州法管制,但如果保護人為非美國人,則可能導致信託被認定為美國稅下所指的境外信託。

KEDP補充解釋:對於法院測試、和控制測試,只要其中一個不符合,信託就會被判定為境外信託。

(i) Court Test

A trust satisfies the court test if a federal, state or local court within the United States is able to exercise “primary supervision” over the “administration” of a trust.4 Administration is defined as the “carrying out of the duties imposed by the terms of the trust instrument and applicable law, including maintaining the books and records of the trust, filing tax returns, managing and investing the assets of the trust, defending the trust from suits by creditors, and determining the amount and timing of distributions.” Primary supervision is “the authority to determine substantially all issues regarding the administration of the entire trust.” The regulations make it clear that a court may have primary jurisdiction notwithstanding the fact that another court has jurisdiction over a trustee, a beneficiary or trust property.5 As a practical matter, a trust administered in Delaware, governed by Delaware law and with a Delaware trust company as trustee will typically satisfy the court test. However, as discussed below, the Trust described above likely will fail the control test.

4 Treas. Reg. Section 301.7701-7(a)(1)(i).

5 Treas. Reg. Section 301.7701-7(c)(3)(iv).

如果美國的聯邦、州或地方法院能夠對信託的「行政管理」進行「主要監督」,就會滿足法院的測試,行政管理的定義是「履行信託合約和適用法律規定的義務,包括維護信託帳薄和記錄、提交納稅申報表、管理和投資信託資產、捍衛信託以對抗債權人提起的訴訟,及決定分配的金額和時間。主要監督是「有權判定整個信託行政管理的所有問題」,法規有明確的規定,一個法院可擁有信託的主要管轄權,儘管該信託的受託人、信託項下資產的法律管轄權在另一個法院,實務上,只要行政運作在Delaware州,受Delaware州法管轄和有Delaware受託公司為受託人的信託,通常都會滿足法院測試,然而,如下文所討論的,上述信託有可能會不符合控制測試。

KEDP補充解釋:只要受託人為Delaware的受託公司,並接受Delaware法院的管轄,在Delaware就可以算是滿足法院測試,所以這邊主要討論的是控制測試。

(ii) Control Test

The control test is met if one or more U.S. persons (as defined for federal income tax purposes) have the power, by vote or otherwise, to make all substantial decisions of the trust with no other person having authority to veto such decisions. For this purpose, all persons who have authority to make such decisions are considered, whether or not acting in a fiduciary capacity.6 The Treasury Regulations provide a non-exclusive list of the types of decisions or powers that would be considered “substantial decisions,” including:

6 Treas. Reg. Section 301.7701-7(d)(1)(iii).

如果一個或多個(聯邦所得稅規定下的)美國人有權通過表決或其他方式作出信託的所有實質性決定,並沒有其他人有權否決決定的權力,則控制測試會得到滿足。為此目的,所有有權作出決定的人均會被列入考慮,無論是否以受託人的身分行事。美國財政部有提供一份非排他性的清單,列出被視為「重大决定」的決定或權力類型,其中包括:

KEDP補充解釋:只要美國人能夠通過任何方式做出實質的決定,並不被其他人否決,則就是符合美國控制測試,所以不管其身分,只要能對信託做出重大決定之人都必須列入考慮。

• Whether and when to distribute income or corpus;是否和何時分配收入或本金

• The amount of any distributions; 任何分配金額

• The selection of beneficiaries; 受益人的選擇

• Whether to allocate trust receipts to income or principal; 是否將信託收入款項分配到收益或本金

• Whether to terminate the trust (such as by revoking it); 是否終止信託(例如:撤銷信託)

• Whether to compromise, arbitrate, or abandon claims of the trust; 是否調和、仲裁或放棄對信託的要求

• Whether to sue on behalf of the trust or to defend suits against the trust; 是否代表信託起訴或為信託辦護

• Whether to remove, add or replace a trustee; 是否移除、添加或替換受託人

• Whether to appoint a successor trustee; and 是否指定繼任受託人;和

• Investment decisions.7 投資決定

KEDP補充解釋:以上就是所有重大決定的範圍。

7 However, decisions made by a non-U.S. investment advisor will be considered to be controlled by a U.S. person if that U.S. person has authority to hire and fire the investment advisor.

如果美國人有權聘請和解僱非美國投資顧問,那麼由非美國投資顧問做出的決定將被視為由美國人控制。(如果只是受聘做決策,則要看聘僱者身分)

Power (including veto rights) over a single substantial decision of a trust can cause it to “flunk” the control test and be treated as a foreign trust for tax purposes. Thus, even though the Trust would have a U.S. Trustee, if the Protector is a non-U.S. person for federal income tax purposes (e.g., a nonresident alien) and controls at least one substantial decision of the Trust, such as the power to remove and replace the Trustee or approval rights over any amendments to the trust agreement, then the Trust will be a foreign trust for U.S. tax purposes. Similarly, if a substantial decision of the Trust requires a unanimous decision and one of the decision-makers is a non-U.S. person, the Trust would be treated as a foreign trust under the control test.8 On this basis, the Trust in question would be classified as a foreign trust for U.S. tax purposes.

8 See Treas. Reg. Section 301.7701-7(d)(1)(v), Example 1.

任何一個權力(包括否決權)都有可能導致「控制測試」不合格,並被視為美國稅下所指的境外信託。即使該信託的受託人為美國受託人,但如果保護人是聯邦所得稅下認定的非美國人(例如非居民外國人),並控制至少一個信託的實質性決定權,例如移除和替換受託人的權力或批准修改信託合約,則信託將被視為美國稅下所指的境外信託。同樣,如果信託的重大決定需要一致性通過,而其中一個決策者是非美國人,則該信託的控制測試不合格,將被視為美國稅下所指的境外信託。

KEDP補充解釋:

只要保護人、投資顧問、分配委員、甚至受託人,以上任一角色中由非美國人擔任,並能至少決定以上任一重大決策,這個信託的控制測試就無法滿足,而會變成境外信託。

意思就是在決策之人要非常的純,只要有一個是非美國人,就會破壞控制測試,就算是多數決決策也一樣,只要一個投票者是非美國人,就無法滿足控制測試。

C. U.S. Tax Liabilities and Reporting Requirements

You asked us to explain the U.S. federal tax and reporting obligations for the Trust and whether the revocability of the Trust would impact these requirements. As explained below, although revocability could affect whether the Trust or the Settlor is considered the owner of the underlying income and assets of the Trust for U.S. tax purposes, this should not affect the federal income tax liabilities and reporting requirements of the Settlor, the Trust or the beneficiaries as long as the Trust does not own any U.S. assets or have any U.S. source income and as long as the beneficiaries are not U.S. persons.

您要求我們解釋信託在美國聯邦稅申報義務的相關問題,以及信託的可撤銷性是否會對此造成影響。如下所述,儘管可撤銷性可能會影響為了美國稅之目的,判斷是信託本身或設立人擁有信託財產,但只要信託不持有任何美國資產或有任何美國來源收入,並且受益人不是美國人,就不會影響到設立人、信託或受益人的聯邦所得稅負和申報要求。

KEDP補充解釋:只要維持在境外信託,並且沒有美國境內資產和美國受益人(四頭在外),則不管此境外信託是可撤銷或是不可撤銷,都沒有美國聯邦所得稅的義務。

(i) Revocability and Grantor Trust Rules

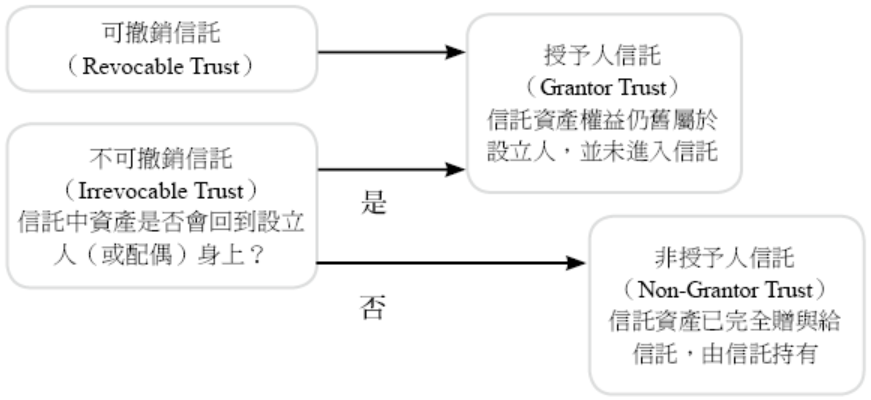

For U.S. federal income tax purposes, trusts are treated either as grantor trusts or as nongrantor trusts. Grantor trusts generally are ignored for federal income tax purposes while nongrantor trusts are treated as separate taxable entities (with a deduction for “distributable net income” distributed to the beneficiaries).

為了美國聯邦所得稅的目的,信託被分為授予人信託或非授予人信託。授予人信託通常會忽略聯邦稅,而非授予人信託會被視為獨立的應稅實體(扣除分配給受益人的「可分配淨收人」)。

KEDP補充解釋:以美國聯邦稅上的角度來看,信託主要考慮的分項是授予人信託及非授予人信託,也就是說,即使是不可撤銷,但是還是授予人信託時,資產依舊是屬於授予人的(設立人)。如果是授予人信託,資產就屬於授予人(設立人),收益也屬於授予人(設立人)的收益,如果是非授予人信託,則信託本身會是一個納稅主體。

要看授予人或是非授予人信託,主要看授予人(設立人)是否有:1.撤銷(拿回)信託本金的權力,或2是本金或收益只能回到授予人(設立人)身上,舉例來說,即使是不可撤銷的信託,但是合約中規定信託資產收益只能到授予人(設立人),這樣信託中資產還是屬於是授予人(設立人)的資產,就是所謂不可撤銷的授予人信託,在此情況下,信託資產還是屬於授予人(設立人)的。

那有沒有可撤銷的非授予人信託?如果是可撤銷基本上就屬於非授予人信託,因此仍一樣是授予人(設立人)的資產。

因此我們在美國稅的觀點考慮信託的時候,除了可撤銷、不可撤銷外,尚需考量是授予人信託或是非授予人信託的觀點。

因此結論是:1.可撤銷信託一定是授予人信託。2.不可撤銷信託還要看信託資產的收益和和本金是否會回到自己(或配偶)身上。

Various rights and administrative powers can trigger grantor trust status if the grantor is a U.S. person for federal income tax purposes.9 However, the grantor trust rules are much more restrictive for nonresident aliens, such as the Settlor, than for U.S. citizens and residents. Subject to a limited grandfathering rule for older trusts, a trust generally is not treated as a grantor trust with respect to a nonresident alien such as the Settlor unless it meets either of the following two requirements:10

如果設立人是聯邦所得稅下定義的美國人,則各種權利和行政權力都可能使判定為授予人信託。然而,授予人信託法規對於非居民的限制要比美國公民和居民要嚴格得多。受限於設立時間較久遠的信託中祖父母規則的限制,除非滿足以下兩個要求之一,否則非居民(例如設立人為非居民的)信託通常不會被視為授予人信託:

9 Sections 673 to 677.

10 Section 672(f). An exception also exists for certain compensatory trusts.

• The grantor has the power to revoke the trust and revest its assets in himself either alone or with the consent of a related or subordinate party subservient to the grantor; or

授予人可以獨自或經有關方或從屬方同意,撤銷信託或重新投資信託資產。

KEDP補充解釋:是否有信託撤銷之權力。

• During the grantor’s lifetime trust distributions (whether income or principal) may be made only to the grantor or the grantor’s spouse. However, this can include payments in discharge of certain legal obligations of the grantor or the grantor’s spouse.11

授予人的終身信託分配(不論是收入還是本金),只能分配給授予人本人或其配偶。包含了支付特定費用,此特定費用為解除授予人或其配偶的法定義務而產生。

KEDP補充解釋:就我們的觀點,意即本金和收益「只能」分給授予人(設立人)或其配偶。

For purposes of establishing grantor trust status under the first prong, the grantor is treated as having a power to revoke the trust and revest the trust’s assets for a taxable year only if the grantor has such power for a total of 183 or more days during the taxable year of the trust.12 The revocability requirement must be satisfied for each year. If the nonresident alien grantor of a revocable trust becomes incapacitated and no one has the authority to revoke the trust on the grantor’s behalf, then the trust will cease to be a grantor trust under the revocable trust exception. Once a trust ceases to qualify as a grantor trust under this exception, it cannot be “revived” by restoring the revocation power.13 Thus, it is advisable to have a guardian or other designated person in place with unrestricted authority to revoke on the grantor’s behalf in the event of his incapacity so that the trust may continue to qualify under this exception during the grantor’s period of incapacity.

11 Treas. Reg. Section 1.672(f)-3(b)(2)(i).

12 If the first or last taxable year of the trust (including the year of the grantor's death) is less than 183 days, then the grantor must hold such power for each day of the stub year. See Treas. Reg. Section 1.672(f)-3(a)(2).

如果信託第一年與最後一年稅務年小於183天(包含設立人的死亡年度),則設立人必須每一天都確認持有該權力。

13 Treas. Reg. Section 1.672(f)-3(a)(1).

「為了達到在第一個條件下建立授予人信託的目的,只有在授予人在該稅務年度擁有撤銷權力達到或超過183天的情況下,授予人被視作擁有權力去撤回信託並再投資信託資產,每年都須滿足擁有撤銷權力的條件,如果可撤銷信託之外國授予人變成無行為能力,且沒有授權給任何人權力來撤銷此信託時,此信託將會在可撤銷信託的例外下,不在滿足授予人信託的條件。在此例外下,一旦信託不再滿足授予人信託的條件,此時不可藉回復之權力來恢復撤銷權,因此,建議最好指定監護人或是其他指定人選,在授予人無行為能力時有不受限制的權力來代替授予人撤回信託,如此一來信託可在授予人無行為能力期間,繼續滿足授予人信託的條件。

KEDP補充解釋:以上旨在說明,為了在可撤銷的觀點上,達到授予人信託的目的,設立人需擁有撤銷信託資產收益的權力,且擁有此權力一年中至少達到183天,才會成為授予人信託。這個條件的滿足需要每年做檢視,因為一旦信託只要變成了非授予人信託,就不可以再回復了,所以建議找一個代理人,如果在授予人無行為能力時,代替授予人(設立人),藉由任何形式(譬如協助資產收益繼續只給到授予人(設立人),或替信託資產分配做決定),這樣就不會讓信託變成非授予人信託。

If the consent of a third-party is required in order to revoke the trust, the party must be a “related or subordinate party,” which is defined as a nonadverse party who is either the grantor’s spouse (if living with the grantor), or the grantor’s father, mother, issue, brother or sister, an employee of the grantor, a corporation or an employee of a corporation in which the stockholdings of the grantor and the trust are “significant” from the viewpoint of voting control, or a subordinate employee of a corporation in which the grantor is an executive.14 A related or subordinate party is presumed to be subservient to the grantor for purposes of the revocation requirement unless such party is shown not to be subservient by a preponderance of the evidence.

14 Section 672(c). A nonadverse party is a person who does not have a substantial beneficial interest in the trust (including a general power of appointment) that would be adversely affected by the exercise or non-exercise of the power which he possesses with respect to the trust (in this case, the revocation power).

非對立方是指對信託沒有實質利益(包含一般委任權)的人,並將因行使或不行使由該信託所賦予的權力而產生不利影響(此狀況下指的是撤銷權)。

如果撤銷此信託需要第三方的同意,此第三方須為「關係人或是有從屬關係之人」,也就是定義為非對立方,其可以為授予人的配偶(如果與授予人一起生活),或是授予人的父母親及兄弟姊妹、雇員、公司或是授予人在股票投票控制上為重大之公司雇員,授予人為執行者之公司從屬雇員。關係方或從屬方被假設在撤銷的目的上是站在授予人的立場的,除非有證據顯示該方並非站在授予人那一邊。

KEDP補充解釋:如果需要第三方同意才能撤銷此信託,則第三方應為站在設立人的立場,於是仍為一個授予人信託,如果這個第三方是獨立個人,並不站支持設立人,則信託有可能會變成非授予人信託。(此處的觀點在考慮授予人、非授予人信託,並非從可撤銷、不可撤銷信託的觀點來考慮,然而,若一定要從撤銷權限的觀點來考慮的話,需要第三方獨立個人決定才能撤銷。因此,這就不算是可撤銷信託,資產也非屬於授予人(設立人)。

Assuming the Trust satisfies the above requirements for revocability, it will qualify as a grantor trust. As such, any items of income, gain, loss or deduction will flow up from the Trust to the Settlor for U.S. federal income tax purposes. If the Settlor is a nonresident alien, then the only Trust income that will be subject to federal income taxes will be income from U.S. sources and income that is effectively connected with the conduct of a trade or business in the U.S.15 If the Trust’s assets consist only of its shares of the BVI holding company which in turn holds only the Taiwanese and Chinese subsidiaries, then neither the Trust nor the Settlor should have any income to report on a U.S. federal income tax return.

15 Note that interests in partnerships that are themselves engaged in a U.S. trade or business can give rise to a return filing obligation and potential tax liabilities in the U.S. for a non-U.S. partners.

假設信託滿足上述回復需求,其將會成為合格之授予人信託。如此,在聯邦所得稅目的上,任何項目的收入、利得、損失,或是抵扣將會從信託流回設立人。如果設立人為非居民外國人,則唯一會歸屬於聯邦所得稅的信託收入將會是在美國境內從事商業行為之有效連結的美國來源所得。如果信託中資產組成僅為持有臺灣及中國子公司之BVI公司股權,則信託及設立人皆無須申報美國聯邦所得。

KEDP補充解釋:所以從上所述,以美國聯邦稅的觀點來看,只要是授予人信託,信託資產和收益就是屬於授予人(設立人)的,如果是非授予人信託,則信託資產及收益就是屬於信託本身的,則信託本身就是個獨立課稅個體。

(ii) Whether Irrevocable Trust Can Qualify as Grantor Trust

If the Trust is irrevocable, then it may still qualify as a grantor trust if distributions, whether of income or principal, may be made only to the Settlor or to the Settlor’s spouse during the Settlor’s lifetime. As with the case of a revocable trust, the trust must satisfy this requirement for each year of its existence. If it fails to satisfy this requirement in any given year, then it cannot be requalified as a grantor trust.

如果該信託為不可撤銷信託,在設立人在世時,其收人或本金僅被支付給設立人或是設立人的配偶,則該信託仍可以滿足為授予人信託,就像在可撤銷信託的情況下,信託須每年滿足存在性的要求。如果在任何年度無法滿足其存在性之要求,則其不再符合授予人信託的狀態。

KEDP補充解釋:這邊回應上述說法,即使他是一個不可撤銷信託,但是授予人(股立人)有權力影響信託資產收益分配,或是此信託的本金和收益」只有給回授予人(設立人),則還是授予人信託,信託資產收益還是屬於授予人(設立人)的。

(iii) Nongrantor Trust Status

If the Trust fails to qualify as a grantor trust, it will be taxed as a nongrantor trust, meaning that income earned by the Trust would be taxed (if at all) at the trust level. However, foreign nongrantor trusts generally are taxed in the same manner as nonresident alien individuals – i.e., on income from U.S. sources and income that is effectively connected with the conduct of a trade or business in the U.S.16 Based on the facts described above, the Trust should not have any income that would be taxable in the U.S.

16 See Section 641(b).

如果信託不符合成為授予人信託的條件,會按照非授予人信託方式課稅,意思就是信託所賺得之任何收入將會在信託層級被課稅,然而,外國非授予人信託一般會按照非居民外國個人的方式課稅。舉例來說,像是美國來源所得,和有效連結美國境內運營活動之所得。取決於上述描述之情況,信託應不會有任何美國之應稅所得。

KEDP補充解釋:如果信託不是授予人信託,那自然就是非授予人信託(注意:稅上並不考慮所謂可撤銷、不可撤銷,而是授予人、非授予人),非授予人信託本身會有稅務義務,但是因為這信託並非美國信託,也沒有美國來源所得,受益人也非美國人,因此不會有任何美國稅的問題(除非有美國來源所得),主要法源依據來自:26CFR §301.7701-7-domestic and foreign。

(iv) Filing Obligations

a. No Income Tax Return不須申報聯邦所得稅表

Because both the Trust and its Settlor would be non-U.S. persons, neither the Trust nor the Settlor would have a U.S. federal income tax return filing obligation if the Trust’s only asset is its stock in the BVI corporation, regardless of whether the Trust is a grantor trust or a nongrantor trust. The only form that it would appear to be obligated to file in the U.S. is the FBAR.

如果信託僅持有BVI公司股權,則信託和設立人皆無美國聯邦所得稅表申報義務,不論信託是否是授予人信託或是非授予人信託,因為信託和設立人皆非美國人。

因為四頭在外,此信託就是一個境外信託,只要是境外信託,沒有美國來源所得,沒有美國受益人,就不會有美國稅的問題,不管是授予人或是非授予人信託。

b. FinCEN Form 114 (FBAR) 須申報FinCEN 114 (FBAR)

Under the Bank Secrecy Act, a U.S. person who has a financial interest in, or signature or other authority over one or more bank, securities or other financial accounts in a foreign country must file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (a.k.a. FBAR), for each calendar year, if the accounts exceed $10,000 in value in the aggregate. The FBAR is generally due April 15th of the year following the year to which the FBAR relates, with an automatic extension until October 15th. Civil penalties for noncompliance range from $10,000 for non-willful violations to 50% of the value of the account for willfully false violations. The FBAR is completely separate from the tax return and in fact is filed pursuant to a different title (Title 31) of the United States Code.

在銀行保密法規定下,美國人對美國境外之銀行帳戶、股票帳戶、或是其他金融帳戶,擁有金融利益,或是簽署或其他權力,每個歷年度只要此帳戶價值加總超過10,000 美元,則必須要申報Fincen 114表。FBAR申報通常截止日為隔年的4月15日,並可隨聯邦稅表延期至10月15日。對於不遵守此規定之民事處罰範圍為10,000美元的非故意違規罰款,至50%的總帳戶價值的故意違規罰款。FBAR是完全從稅表分離之申報表格,甚至其規定法源也不同。

Even if a U.S. person is not the owner of record or holder of legal title to a foreign financial account, such person can be deemed to have a financial interest in a foreign account in situations in which the U.S. person’s ownership or control over the owner of record or holder of legal title rises to such a level that the U.S. person is deemed to have a financial interest. Accordingly, the Trustee would have FBAR filing obligations in respect of foreign financial accounts held directly by the Trust or indirectly through the BVI, Chinese or Taiwanese companies because the companies are owned more than 50% (directly or indirectly) by the Trust.

即使美國人不是外國金融帳戶的合法所有權持有人,在美國人擁有受益權或控制權的情況下,該人也可被視為是外國帳戶的持有人。因此,針對信託項下直接或間接通過英屬維京群島、中國或臺灣公司持有之外國金融帳戶,受託人有FBAR之申報義務,因為信託(直接或間接)擁有這些公司超過50%的股權。

KEDP補充解釋:因為美國受託公司對境外帳戶會有控制權或受益權,因此即使是非美國信託,還是需要對境外帳戶申報FBAR。

It is important to note that even though the Trust would be structured to qualify as a foreign trust for U.S. tax purposes, it would be settled under the laws of a U.S. state, which would cause the Trust to be treated as a U.S. trust for FBAR purposes.17

17 Different definitions apply to establish U.S. person status under Title 31 than under the Tax Code (Title 26).

值得注意的是,儘管該信託被定義為符合美國稅收目的的外國信託,信託將被設立在美國某個州,由該州州法為信託管轄法律,將導致信託被視為須申報FBAR的美國信託。

c. IRS Form 5472

Unless (1) the Trust owns, directly or indirectly, 100% of the membership interest in a U.S. limited liability company or other U.S. business entity that is disregarded for U.S. federal tax purposes or at least 25% of the stock of a U.S. corporation, and (2) certain related party transactions occur between the Trust or certain foreign related parties and the U.S. disregarded entity or corporation, we do not see any apparent trigger for a Form 5472 reporting obligation. We note that if either the BVI corporation, the Chinese subsidiary or the Taiwanese subsidiary is engaged in a U.S. trade or business, then the corporation itself potentially could have a Form 5472 reporting obligation in a given year, but the basis for the corporation’s filing obligation in such case would be its U.S. activities and not the Trust’s direct or indirect ownership of the corporation. Our understanding is that these companies are not operating in the U.S.

除非(1)該信託直接或間接地擁有美國有限責任公司100%的權益、或是其他美國商業實體其在美國聯邦稅收上被視為是穿透實體,或是美國公司股票至少25%,以及(2)該信託與其它關聯方信託或是外國關聯方與美國穿透企業或法人之間發生的某些關聯交易,否則我們看不到有任何明顯申報5472表的義務。我們注意到如果BVI公司、中國或是臺灣子公司從事與美國之貿易及業務,那麼公司本身在某一年可能會有申報5472表的義務。該情形下,公司的申報義務基礎是在美國之貿易及業務活動,而不是信託對公司的直接或間接擁有權。當然我們的理解是這些公司都不在美國運作。

KEDP補充解釋:申報5472表規定,外國人持股美國公司超過25%,或是外國人100%持股美國穿透實體時才需要申報,否則不用。

(v) Distributions from Trust to Non-U.S. Beneficiaries

Whether the Trust is a grantor trust or a nongrantor trust, distributions to non-U.S. beneficiaries should not be subject to withholding taxes in the U.S. If the Trust’s only source of income is the distributions it receives from the BVI corporation, then the distributions from the BVI corporation should not be subject to U.S. withholding tax either. Note that if the Trust were to invest in U.S. securities, dividends paid to the Trust would be reportable by the payor on IRS Form 1042-S and subject to withholding taxes, but neither the Trust nor the Settlor would be required to file a tax return in the U.S. solely on account of such distributions if they were properly reported on IRS Form 1042-S and all taxes required to be withheld were withheld and remitted to the IRS by the withholding agent. Our understanding is that the Trust does not hold any U.S. securities or other U.S. income-producing assets.

無論該信託是授予人還是非授予人信託,信託分配給非美國受益人都不應在美國繳納預扣稅。如果信託的收人來源是從英屬維京群島公司得到的收人,那麼由英屬維京群島公司的分配也不應該受到美國的預扣稅。請注意,如果信託投資於美國證券,支付給信託的股息將由支付者在國稅局1042-S表上報告,並須繳納預扣稅。如果1042-S表已經正確的中報且做出正確的預扣稅並支付給IRS,則信託和設立人都不需要對此收入申報任何稅表,我們的理解是,該信託不持有任何美國證券或其他美國的資產。

(vi) Nongrantor Trust Status and U.S. Beneficiaries

Nongrantor trust status generally should not create any U.S. tax issues for the non-U.S. beneficiaries. However, foreign nongrantor trust status could be problematic if there are U.S. beneficiaries in the future. Although income distributed currently (or within the first 65 days of the following calendar year with a timely election by the trust) preserves its character in the hands of the U.S. beneficiary, income that is accumulated within the trust and distributed to a U.S. beneficiary in a later tax year generally is taxed as ordinary income and potentially subject to additional interest charges under the “throwback” rules. This includes capital gains and foreign source income that would not be taxable to the trust itself. Further, U.S. beneficiaries could have significant reporting requirements, including IRS Forms 3520, 8938, 5471 and 8621, among others. The U.S. beneficiaries also could be subject to foreign anti-deferral rules with respect to the Trust’s direct interest in the BVI holding company and its indirect interest in the Chinese and Taiwanese operating subsidiaries. Thus, if there is any likelihood that the Trust may ultimately have U.S. beneficiaries, the Trust should be structured to qualify as a grantor trust (for example, by ensuring that it satisfies the requirements for revocability as described above) during his or her lifetime and should avoid direct investments in U.S. assets. Distributions from a foreign grantor trust to U.S. beneficiaries would not be taxable to the U.S. beneficiaries (although they would be reportable on IRS Form 3520). Further planning would be required in order to ensure that the U.S. beneficiaries could be put into a tax-efficient structure after the Settlor dies and the Trust becomes a foreign nongrantor trust.

非授予人信託一般對非美國受益人不會產生美國稅務的問題。然而,如果未來會有美國籍受益人,則境外非授予人信託的稅務問題將會很棘手。雖然信託分配當年度收入(或在信託即時勾選後,下個稅務年度的65天以前分配)能將收入的種類保留在美國受益人手上,但是如果在信託裡面累積到下一個稅務年度分配,將會以一般性收入來計算稅率,並且根據回溯稅必須繳納額外的利息費用,這些收入包含資本利得與本身不會對信託徵稅的海外收入。此外,美國受益人可能需要有一堆表格要申報,其中包括表格3520、8938、5471和8621等。美國受益人對於信託下的BVI公司以及中國或臺灣的子公司也可能受到「境外反推延規則的約束」(CFC/PFIC)。

KEDP補充解釋:如果境外非授予人信託有美國受益人,則會有回溯稅的問題,非常麻煩,且美國受益人對於外國非授予人信託所持有之境外資產也有申報義務,同樣可能也有CFC的問題。

因此,如果信託最終會擁有美籍受益人,則信託的結構最好滿足授予人信託的條件(確保以上可撤銷性的要求),並避免直接投資美國資產,來自境外授予人信託給美國受益人之分配不會對美國受益人課稅(美國受益人須申報3520表),但該信託在設立人去世之前必須進行規劃來確保美國受益人更高的稅務效益,並且避免成為境外非授予人信託。

KEDP補充解釋:所以如果是美籍受益人,就不會讓客戶成立外國非授予人信託,以KEDP來說,若客戶後代有美籍受益人,是不會讓客戶成立外國不可撤銷信託的。

D. CRS Compliance

As noted above, the advice contained in this memorandum is limited to U.S. federal tax and reporting requirements for the Trust. We strongly recommend that the Settlor and anyone else contributing assets to the Trust seek advice from local country counsel, both in his or her country of residence and in the countries where the underlying companies are organized, as to the local tax and reporting consequences of contributing the assets to the Trust and holding them in the Trust on an ongoing basis. For example, it should be confirmed that there are no disclosure obligations under the Common Reporting Standard (“CRS”). Although the United States has not adopted CRS, we understand that both BVI and China have agreed to adopt CRS and that Taiwan may be taking steps to do so as well. In some CRS jurisdictions, the transfer of assets to a non-participating jurisdiction, such as the United States, could itself be a reportable transaction, with reporting implications for the Settlor, the Protector and the beneficiaries. There could be other reporting requirements or tax consequences outside the scope of CRS.

如上所述,本備忘錄中的建議僅限於美國聯邦稅和信託申報要求。我們強烈建議設立人和向本信託提供資產的任何人向本當地國家的律師尋求建議,包括其居住國和相關受託公司所在國家的當地稅務及後續將資產留給信託並持續持有信託。例如,應該可以確認在通用報告標準(CRS)下美國沒有披露義務,雖然美國尚未採用CRS,但我們知道BVI和中國都同意採用CRS,臺灣也可能正在採取措施,在一些CRS司法管轄區,資產轉移到非參與司法管轄權(如美國),對設立人、保護人和受益人本身可能是一個可申報的交易,在CRS範圍之外可能有其他申報內容。